Federal national mortgage association fnma stock chart technical analysis

Table of Contents

Table of Contents

FNMA Quote: An Overview

With the recent volatility in the housing market, many investors are looking for stability in their investments. FNMA Quote is one such investment that promises long-term gains but is subject to a variety of risks. In this article, we will explore the ins and outs of FNMA Quote and related factors that investors should keep in mind.

Pain Points of FNMA Quote

FNMA Quote is a high-risk, high-reward investment. While it has the potential for significant profits, it is also subject to a number of risks and uncertainties, including fluctuations in housing prices, regulatory changes, and interest rate fluctuations. As a result, investors should carefully consider their risk tolerance before investing in FNMA Quote.

The target of FNMA Quote

FNMA Quote is specifically targeted towards investors looking for a high-risk, high-reward investment in the housing market. The investment is intended to provide long-term stability and profits in a volatile market.

Summary of Key Points

FNMA Quote is a high-risk, high-reward investment in the housing market. It offers long-term stability and profits, but is subject to a variety of risks and uncertainties. Investors should carefully consider their risk tolerance before investing in FNMA Quote.

What is FNMA Quote?

FNMA Quote is an investment in the Federal National Mortgage Association, which is commonly referred to as Fannie Mae. Fannie Mae is a government-sponsored enterprise that was created to provide stability and liquidity to the US housing market. FNMA Quote offers investors the opportunity to invest in this enterprise through the stock market.

As a result, investors in FNMA Quote are essentially investing in the US housing market as a whole. This investment is subject to a variety of factors that can impact the housing market, including changes in interest rates, regulatory changes, and fluctuations in housing prices.

Risks and Rewards

Investing in FNMA Quote comes with a variety of risks and rewards. The rewards can be significant, with the potential for long-term stability and profits. However, the risks are also significant and should be carefully considered before investing.

One of the biggest risks of investing in FNMA Quote is the volatility of the US housing market. Changes in interest rates, regulatory changes, and fluctuations in housing prices can all impact the value of the investment. As a result, investors in FNMA Quote should carefully consider their risk tolerance and investment goals before investing.

Regulatory Changes and Risks

Another risk associated with FNMA Quote is regulatory changes. The US government is a major stakeholder in Fannie Mae and has significant control over its operations. As a result, changes in government policies or regulations can impact the value of the investment. Additionally, any changes to Fannie Mae’s structure or operations can also impact the value of FNMA Quote.

Personal Experience with FNMA Quote

As an investor in FNMA Quote, I have experienced both the rewards and the risks associated with this investment. While I have seen significant profits over the long term, I have also experienced significant losses during periods of market volatility. As a result, I have learned to carefully consider my risk tolerance and investment goals before making any investment decisions.

FAQs about FNMA Quote

Q: What is FNMA Quote?

A: FNMA Quote is an investment in the Federal National Mortgage Association, which is commonly referred to as Fannie Mae. This investment provides investors with the opportunity to invest in the US housing market through the stock market.

Q: What are the risks associated with FNMA Quote?

A: The biggest risks associated with FNMA Quote include volatility in the US housing market, regulatory changes, and changes to Fannie Mae’s structure or operations.

Q: What are the rewards of investing in FNMA Quote?

A: Investing in FNMA Quote can provide investors with significant long-term stability and profits.

Q: Is FNMA Quote a good investment?

A: The suitability of FNMA Quote as an investment will depend on an individual investor’s risk tolerance and investment goals. As with any investment, investors should carefully consider the risks and rewards before investing.

Conclusion of FNMA Quote

FNMA Quote is a high-risk, high-reward investment in the US housing market. While it offers the potential for long-term stability and profits, it is also subject to a variety of risks and uncertainties. As a result, investors should carefully consider their investment goals and risk tolerance before investing.

Gallery

FNMA Stock Price And Chart — OTC:FNMA — TradingView

Photo Credit by: bing.com / fnma tradingview views chart

Fnma Quote - ShortQuotes.cc

Photo Credit by: bing.com /

Fannie Mae (QB) Stock Quote. FNMA - Stock Price, News, Charts, Message

Photo Credit by: bing.com / fnma

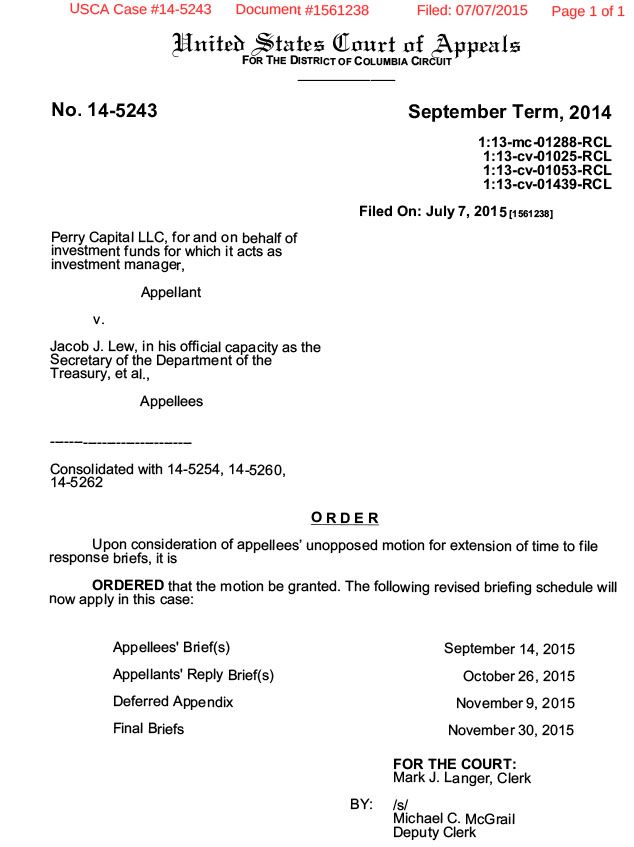

Federal National Mortgage Association (FNMA) Stock Chart Technical Analysis

Photo Credit by: bing.com / fnma mortgage federal association national claytrader

Fannie Mae (FNMA): Quote:

Photo Credit by: bing.com /