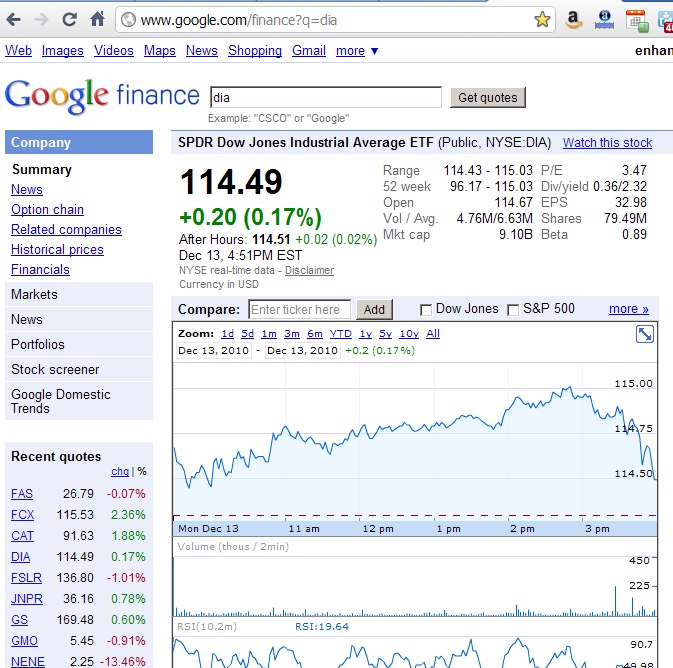

What if i get hurt by a driver with insufficient insurance or none at

Table of Contents

Table of Contents

Are you worried about how auto insurance quotes can impact your credit? If so, you’re not alone. Many people don’t realize that seeking multiple auto insurance quotes can hurt their credit score. But don’t worry, we’re here to help you navigate this complex issue and give you the information you need to make informed decisions about your insurance.

The Impact of Auto Insurance Quotes on Your Credit

When you apply for auto insurance quotes, insurance companies will typically run a credit check to determine your creditworthiness. While the impact of a single credit check is small, multiple credit checks in a short period can lower your credit score. This is because credit scoring algorithms view multiple credit checks as a sign that you may be taking on too much debt or are experiencing financial instability.

Can Auto Insurance Quotes Hurt Your Credit?

The short answer is yes, multiple auto insurance quotes can hurt your credit. However, the impact is typically small and temporary. As long as you limit your auto insurance quote requests to a short period and try to get several quotes from the same insurance company, the impact on your credit should be minimal.

How to Get Auto Insurance Quotes Without Hurting Your Credit

If you’re worried about the impact of auto insurance quotes on your credit, there are a few things you can do to minimize the impact:

- Limit your quote requests to a short period, such as two weeks, to reduce the impact on your credit score.

- Try to get multiple quotes from the same insurance company instead of applying for quotes from multiple companies.

- Consider working with an independent insurance agent who can provide quotes from multiple companies without requiring multiple credit checks.

My Personal Experience with Auto Insurance Quotes and Credit

When I was shopping around for auto insurance quotes, I was worried about the impact on my credit score. I did some research and found that requesting multiple quotes within a short period of time shouldn’t have a significant impact on my credit. I ended up getting several quotes from the same insurance company, which helped minimize the impact even further.

Overall, I was able to get the coverage I needed without hurting my credit. However, it’s important to do your own research and understand the potential impact of auto insurance quotes on your credit before making any decisions.

The Bottom Line

Auto insurance quotes can impact your credit score, but the impact is typically small and temporary. By limiting your quote requests to a short period and getting multiple quotes from the same company, you can reduce the impact on your credit score. Additionally, working with an independent insurance agent can provide you with quotes from multiple companies without requiring multiple credit checks. So don’t let the fear of hurting your credit score keep you from getting the insurance coverage you need.

Question and Answer

1. What is a credit check?

A credit check is a review of an individual’s credit history to determine their creditworthiness. Insurance companies use credit checks to determine how likely you are to make your insurance payments on time.

2. What is a good credit score for auto insurance?

A good credit score for auto insurance is typically a score of 700 or higher. However, this can vary depending on the insurance company and other factors such as your driving history and location.

3. How often should you shop for auto insurance quotes?

You should shop for auto insurance quotes at least once a year to make sure you’re getting the best rates and coverage for your needs. However, it’s important to limit your quote requests to a short period to minimize the impact on your credit.

4. Can I get auto insurance with bad credit?

Yes, you can still get auto insurance with bad credit. However, you may have to pay higher rates or work with a non-standard insurance company.

Conclusion of Auto Insurance Quotes Hurt Credit

While multiple auto insurance quote requests can hurt your credit, the impact is typically small and temporary. By limiting your quote requests to a short period and working with an independent insurance agent, you can reduce the impact on your credit score. So don’t let the fear of hurting your credit score keep you from getting the insurance coverage you need.

Gallery

Free Car Insurance Quotes - ShortQuotes.cc

Photo Credit by: bing.com / shortquotes

Auto Insurance Quotes Online Michigan - Qoutes Daily

Photo Credit by: bing.com / lansing

Acquire Cheap Full Coverage Car Insurance Online For Young Drivers

Photo Credit by: bing.com / insurance auto car quote companies quotes cheap combined broker drivers cheapest coverage acquire young compare list prlog pros cons plan

Auto Insurance Quotes Car

Photo Credit by: bing.com /

What If I Get Hurt By A Driver With Insufficient Insurance (Or None At

Photo Credit by: bing.com / insufficient highlighted floridacheapcarinsurance